Demand for larger homes surged, share of 800+ sq ft units now 32% in May 2025.

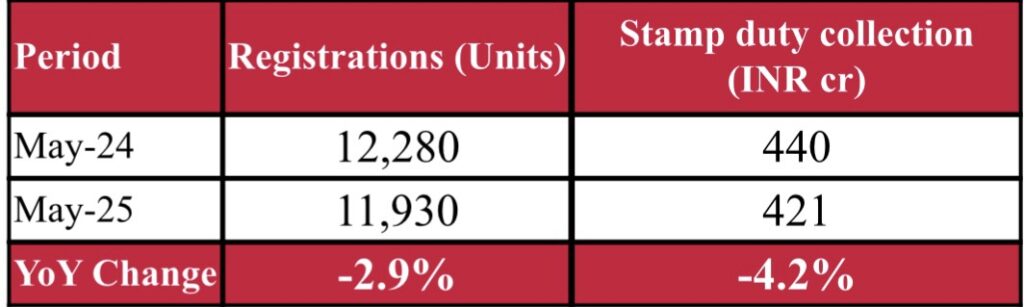

Pune, June 25, 2025: Knight Frank India, in its latest report, highlighted that Pune recorded 11,930 property registrations in May 2025, contributing INR 421 crore in stamp duty revenue. Registrations saw a marginal 3% year-on-year (YoY) decline, while stamp duty collections dipped by 4% YoY. On a month-on-month (MoM) basis, registrations and collections fell by 17% and 23%, respectively. This is the lowest volume for of registration since October 2024.

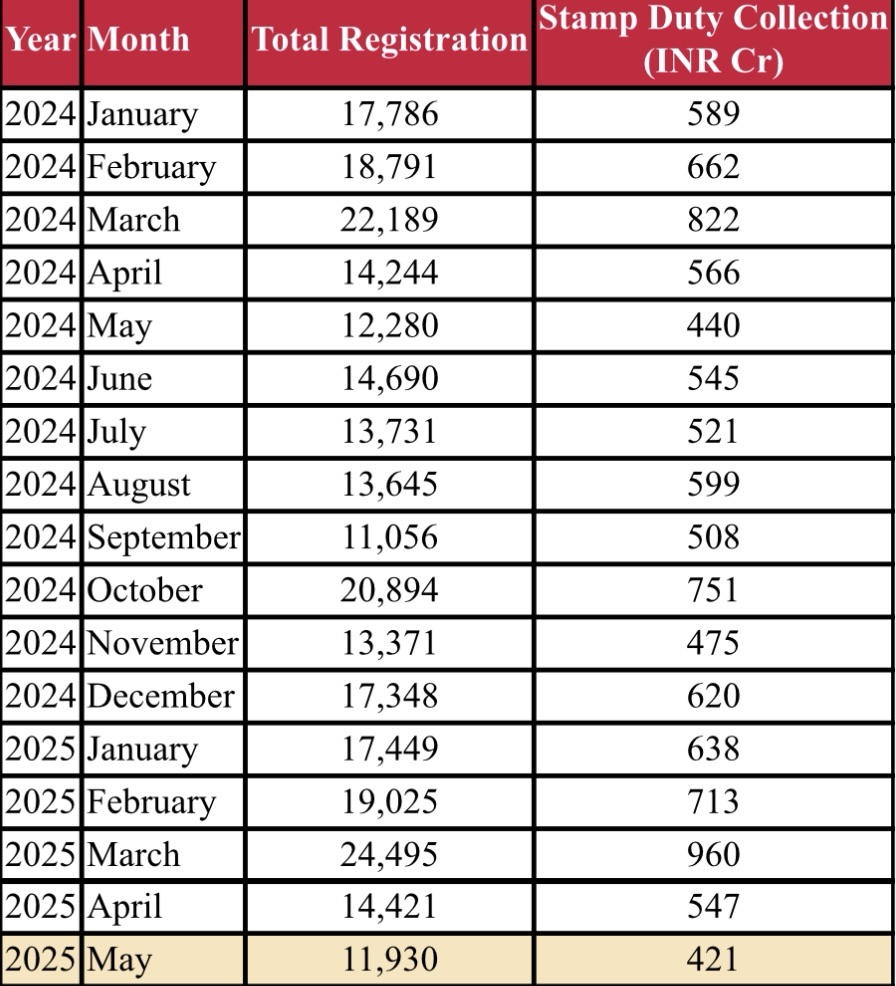

Property registrations, Value of property and Stamp duty collection

Property registration and Stamp duty collection

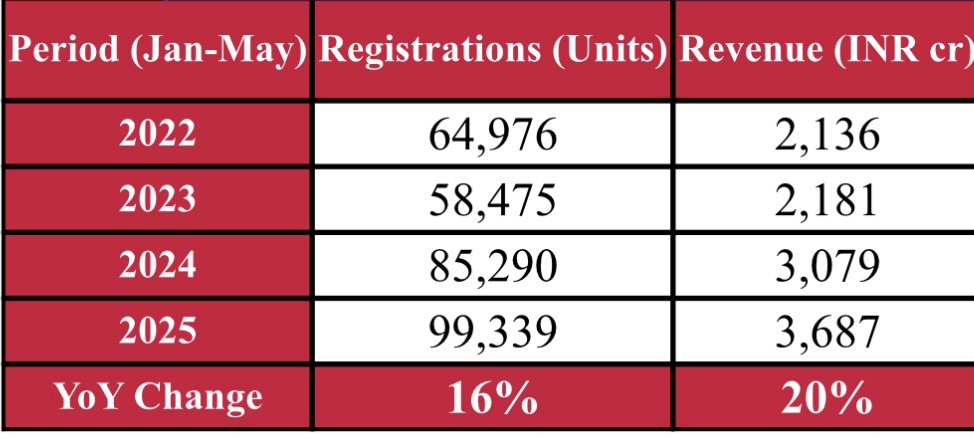

However, from a year-to-date (YTD) perspective (January – May), Pune’s property market appears stable, recording its highest property registrations and stamp duty collections for the first five months of the year in the past four years at over 99,300 units. Compared to the same period last year, property registrations rose by 16%, inching towards the 1 lakh mark,while stamp duty collections saw an 20% increase.

Property registration and Stamp duty collection

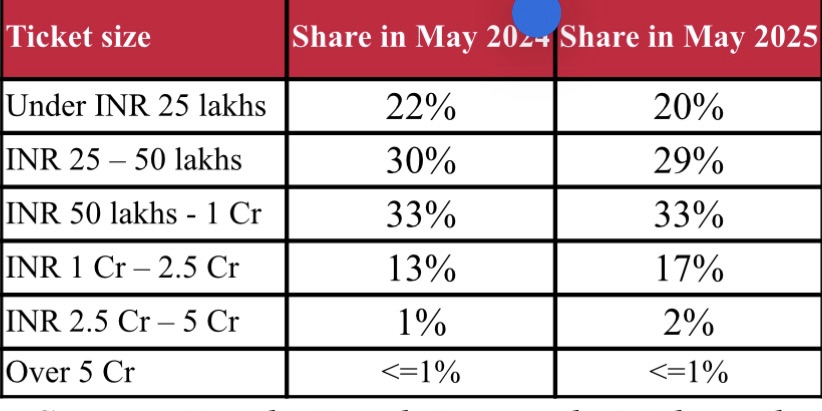

The share of homes priced above INR 1 crore rose from 14% in May 2024 to 19% in May 2025, highlighting growing interest in premium housing. However, with properties priced up to INR 1 crore still accounting for the overwhelming majority at 81%, the overall demand remains largely anchored in the up to 1 crore segment, indicating a market that is expanding at the top while staying broad-based at its core.

Share of ticket size for residential property transactions

Shishir Baijal, Chairman & Managing Director, Knight Frank India, stated, “In May 2025, Pune’s residential market recorded a 3% YoY decline in property registrations, primarily due to slower momentum in the INR 1–5 crore price segment, However, on a year-to-date basis, the market remains on a strong footing — registrations rose 16% YoY to 99,339 units, just shy of the 1 lakh mark, while stamp duty collections surged 20% to INR 3,687 crore.”

Higher demand for larger apartments sustains

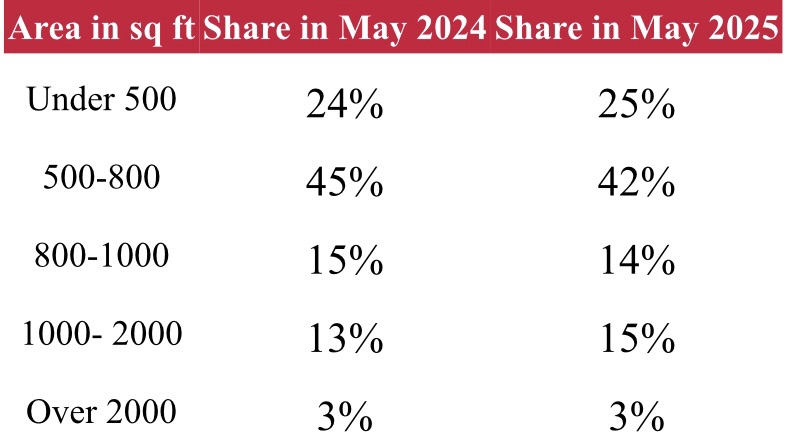

The demand for larger apartments remains strong, with the share of units exceeding 800 sq ft rising from 31% in May2024 to 32% in May 2025. This trend underscores the continued preference for spacious homes in the post-pandemic era.

Share of area for residential property transactions

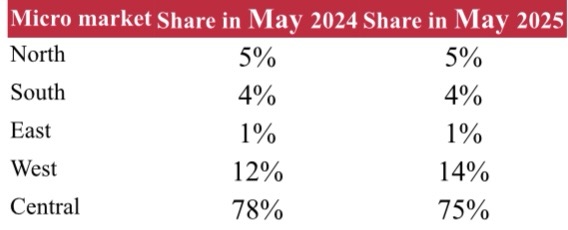

Central Pune contributed 76% of residential transactions in May 2025

In May 2025, Central Pune—including Haveli Taluka, Pune Municipal Corporation (PMC), and Pimpri Chinchwad Municipal Corporation (PCMC)—maintained its lead in residential transactions, accounting for 75% of the market. However, this represented a slight decline from the previous year as emerging developments in other parts of the city catered to evolving homebuyer preferences. West Pune, which includes Mawal, Mulshi, and Velhe, held the second-largest share at 14%, while North, South, and East Pune collectively contributed 10% of transactions during the same period.

Comments are closed.